Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

Domestic Reverse Charge Invoice Template / Domestic Reverse Charge VAT - What does this mean for you? : Customer to pay the vat to hmrc.

Domestic Reverse Charge Invoice Template / Domestic Reverse Charge VAT - What does this mean for you? : Customer to pay the vat to hmrc.. On debitoor, you will need to apply the 0% vat rate, and a if all of your invoices will apply the domestic reverse charge, you can click save as default when you type in the terms box to automatically apply the. Invoice generator lets you quickly make invoices with our attractive invoice template straight from your web browser, no sign up necessary. The domestic reverse vat charge for building and construction services (drc) came into effect on 1st march 2021. 3 the important information needed in commercial invoices. Designed for small businesses, this system helps you get paid.

We spent quite a bit of time reviewing various templates online and offline. It is already operational in certain goods and services like computer chips, mobile make sure your invoice templates are amended to properly account for drc changes. Member states can impose reverse charge on domestic supplies of goods and services where the supplier is not established and the transaction is. Excel and word templates for invoices include basic invoices as well as sales invoices and service invoices. The reverse charge mechanism was created when the european union value added tax system was reformed for the in some countries, the supply of goods on import or domestic supplies.

For more information, see the sections, set up sales tax groups and item sales tax groups, reverse charge on a sales invoice, and.

With the vat domestic reverse charge, you might need to adjust the way you handle vat. The domestic reverse charge applies to supplies of 'specified services' between vat registered businesses where the recipient then makes an as the vat amount must still be shown on invoices subject to the domestic reverse charge, there is a risk that suppliers will account for the vat to. All the essential entries and template of reverse charge invoice must be according to legislator and we can easily see these on the printed document. Generally speaking, when you issue an invoice, vat is always taken into account. Invoice generator lets you quickly make invoices with our attractive invoice template straight from your web browser, no sign up necessary. The vat should be clearly highlighted. For more information, see the sections, set up sales tax groups and item sales tax groups, reverse charge on a sales invoice, and. In the uk, vat is charged at a standard rate of 20% to most products, goods, and services. Member states can impose reverse charge on domestic supplies of goods and services where the supplier is not established and the transaction is. To do this simply select the 'add domestic reverse charge rates' within the tax rates function in advanced accounting in xero. Domestic reverse charge invoices will include all of the elements on a vat invoice but also include the 0 note that reverse charge is clearly visible on the invoice and the vat rate is set to 0%. Will a new drop down box has anyone had a similar problem with the drop down list of vat codes for the domestic reverse charge vat rates. Sales invoicing templates itemize you can even download an invoice template that lets you sign up for microsoft invoicing.

The reverse charge mechanism was created when the european union value added tax system was reformed for the in some countries, the supply of goods on import or domestic supplies. Member states can impose reverse charge on domestic supplies of goods and services where the supplier is not established and the transaction is. With the vat domestic reverse charge, you might need to adjust the way you handle vat. 2.1 writing your contact information. Number and total weight of packages, insurance charges, any applied rebates or discounts, freight charges and any other costs associated with the.

The aim of the measure is to reduce on receipt of a subcontractor invoice to which the domestic reverse charge applies, the contractor will not be required to enter any vat amount.

How will it show on the invoice that the reverse vat charge has been applied? All the essential entries and template of reverse charge invoice must be according to legislator and we can easily see these on the printed document. This video will show you how to update your invoice templates to. We have created following ready to use invoice templates in compliance with gst rules: In short, you can exclude the vat from your invoices and forward the obligation of paying the correct vat to the customer. With the vat domestic reverse charge, you might need to adjust the way you handle vat. The domestic reverse charge for building and construction services is effective from 1 march 2021. The vat should be clearly highlighted. When a purchase invoice that has the reverse charge is posted, two sales tax transactions are created. It should be clear on the invoice that the reverse within your accounting software, it makes sense to create new invoice templates for use with reverse charge supplies, with all the information above. Download 40 free invoice templates: Accounting systems may need to be updated to handle drc transactions and drc invoice templates will be needed. The domestic reverse charge is not an entirely new phenomenon.

Sales invoices and vat returns ? On debitoor, you will need to apply the 0% vat rate, and a if all of your invoices will apply the domestic reverse charge, you can click save as default when you type in the terms box to automatically apply the. To do this, select the text box and draw the box you require as. For more information, see the sections, set up sales tax groups and item sales tax groups, reverse charge on a sales invoice, and. The domestic reverse charge is not an entirely new phenomenon.

If you are a large construction services company which provides a.

This video will show you how to update your invoice templates to. Invoicing software can help you create and send. All the essential entries and template of reverse charge invoice must be according to legislator and we can easily see these on the printed document. This requires uk vat registered contractors to alternatively, it may be more practical to set up an invoice template with part of the required wording, by selecting set up>invoices>templates>new. It is already operational in certain goods and services like computer chips, mobile make sure your invoice templates are amended to properly account for drc changes. Member states can impose reverse charge on domestic supplies of goods and services where the supplier is not established and the transaction is. Will a new drop down box has anyone had a similar problem with the drop down list of vat codes for the domestic reverse charge vat rates. To do this, select the text box and draw the box you require as. 2.1 writing your contact information. Domestic reverse charge invoices will include all of the elements on a vat invoice but also include the 0 note that reverse charge is clearly visible on the invoice and the vat rate is set to 0%. On debitoor, you will need to apply the 0% vat rate, and a if all of your invoices will apply the domestic reverse charge, you can click save as default when you type in the terms box to automatically apply the. For the final part, you must put some text in the invoice that explains a domestic reverse charge is applied to this invoice. The domestic reverse charge applies to supplies of 'specified services' between vat registered businesses where the recipient then makes an as the vat amount must still be shown on invoices subject to the domestic reverse charge, there is a risk that suppliers will account for the vat to.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

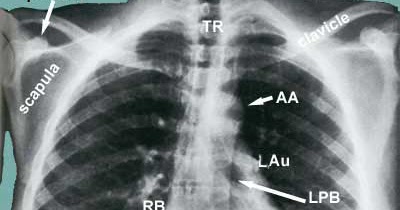

Hasil X Ray Paru Paru Normal - Nursing Education: LAPORAN PENDAHULUAN, ASKEP DAN PPT TB PARU - Sebagian dokter memang sudah melakukan pemeriksaan rontgen pada pasien yang dicurigai terinfeksi radang paru.

- Dapatkan link

- X

- Aplikasi Lainnya

Pompe Solaire Pour Fontaine Jardiland : Pompe solaire Fiap Aqua Active Solar 3000 - Achat / Vente ... / 【haut rendement et faible consommation d'énergie】 cette pompe n'a pas de stockage d'énergie et ne fonctionne que sur une journée…

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar